2023 New Rules On Payment Services

IRS Reprieve

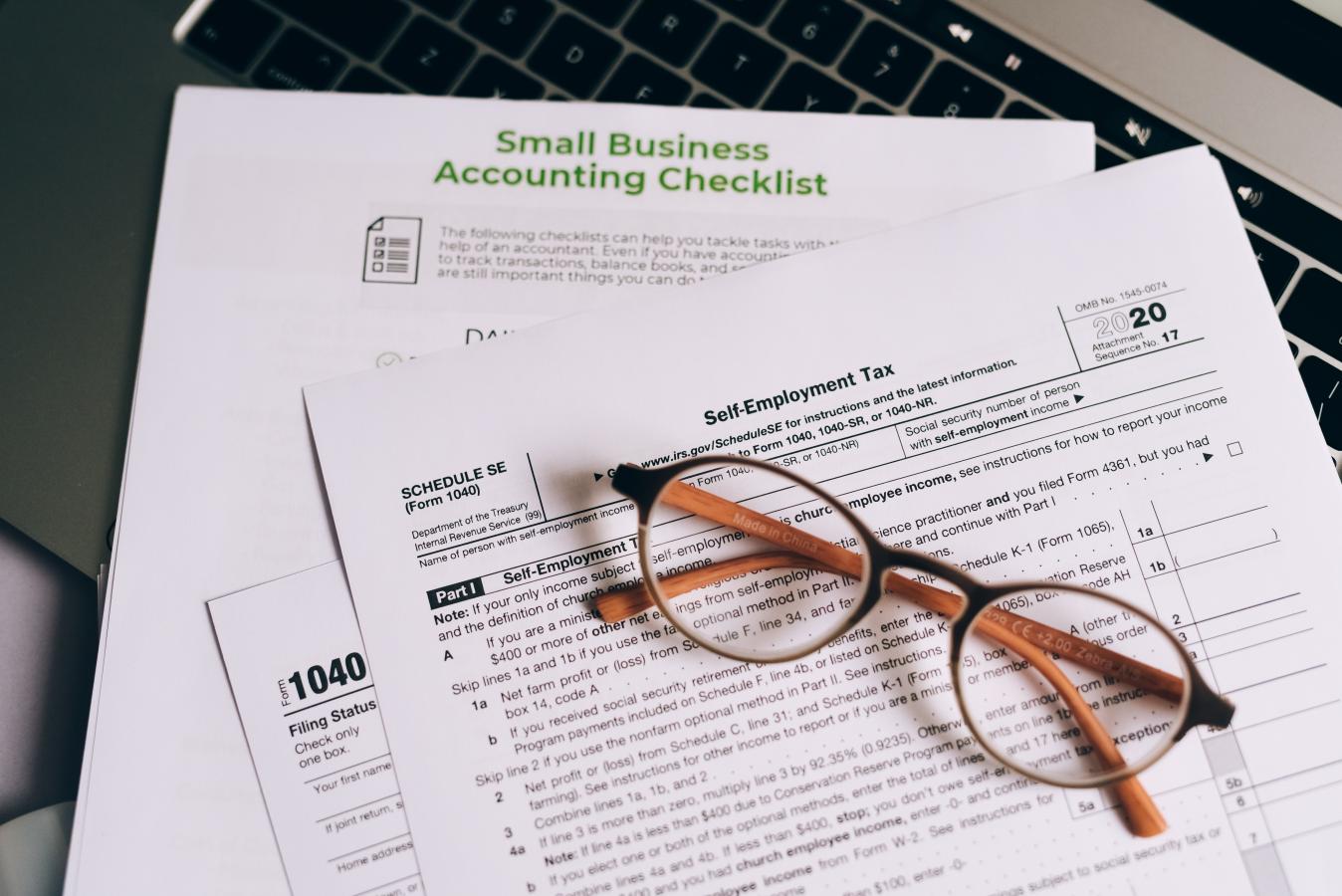

You may have heard of a new rule requiring payment services such as Venmo, PayPal and Cash App to tell the IRS when users earn income greater than $600.

In a last-minute reprieve, though, the Internal Revenue Service has delayed implementation of that rule.

So you won’t be getting a special tax form, known as a 1099-K, if your side hustle on eBay brought in revenue over $600. (You’re still responsible for reporting all your income to the IRS, but you won’t get one of these forms until next year.)

As part of guidance it issued in December, the IRS says these payment services—known as third-party settlement organizations (TPSOs)— won’t have to file this form until next year. “The IRS and Treasury heard a number of concerns regarding the timeline of implementation of these changes under the American Rescue Plan,” said Douglas O’Donnell, acting commissioner of the IRS, in a statement. “To help smooth the transition and ensure clarity for taxpayers, tax professionals and industry, the IRS will delay implementation of the 1099-K changes. The additional time will help reduce confusion during the upcoming 2023 tax filing season and provide more time for taxpayers to prepare and understand the new reporting requirements.”

One of those points of confusion: The reporting requirements are meant only to reflect revenue generated from selling goods or services. A reimbursement from a friend after you buy concert tickets or split a meal doesn’t count. Experts, though, warned that many people would likely end up overpaying their taxes as a result of the forms catching everything in a very big net.

Experts suggest tightening up your own accounting procedures, so you have accurate records of how much income you record on these TPSOs at the end of the year. Some people may even want to set up separate personal and business accounts to make record keeping even easier.

(Existing regulations call for payment services to notify the IRS if users log more than 200 transactions and generate over $20,000. These rules are still in effect.)